Seniors Are Spreading the Truth About Loansharking at Verico the Mortgage Station

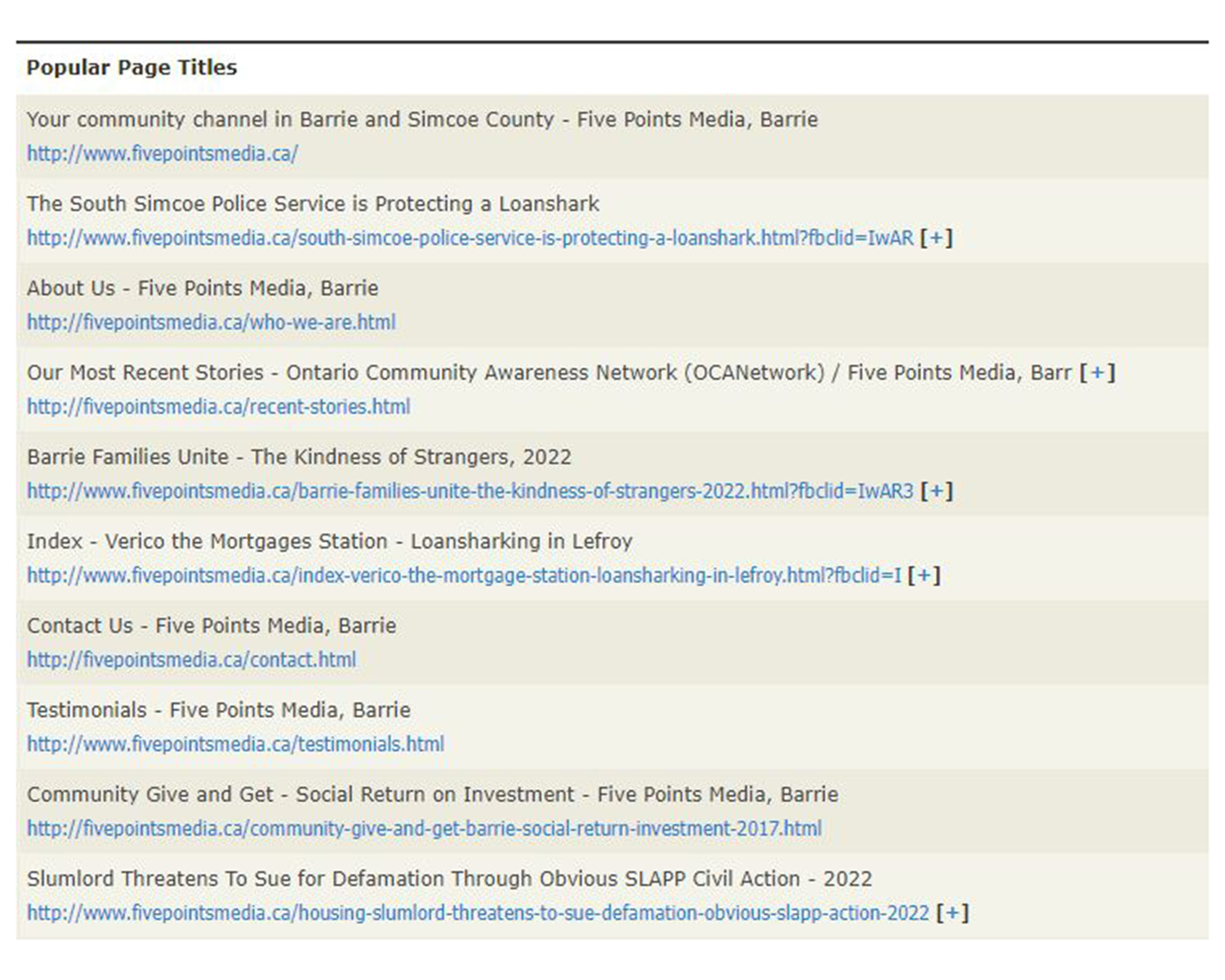

Five Points Media was created in 2014, nine years ago, and some of our videos have drawn more than 50,000 views. However, despite the longevity and popularity of those productions, after just two weeks our page entitled “The South Simcoe Police Service is Protecting a Loanshark” has leaped ahead to become the most popular page on our website other than the home page. Of our top ten pages, the index page of this story about Verico the Mortgage Station, found here, comes in at number six of more than 300 pages.

We have recently learned that a prominent group that is focused on the issues of seniors is sharing our articles via email, apparently to a lot of people who are concerned about elder fraud.

Nobody likes to hear stories of children being hurt or seniors being cheated, as most people have children, and everybody has parents and grandparents. Elder fraud is often not reported because the victim does not know or understand that they have been swindled. It is also often impossible to get anybody to listen or assist in auditing the actions of the thief, con person, or profiteer who took advantage of the senior who entrusted them.

It is now a daily occurrence to hear or read about some new scam being used to cheat seniors out of their hard-earned and often limited money.

Seniors from across the country are visiting our page and asking questions.

In this case, the brokers of Verico the Mortgage Station chose the wrong victim. They knew that our producer is a highly experienced international journalist and that he owns and operates a not-for-profit community channel that has donated more than $600,000.00 worth of programming through 300 plus promotional and fundraising videos to at least 180 charities, community groups, and towns like Barrie and Innisfil. They also know that he owns the only independent video studio known to exist north of Toronto. We welcome everybody to look at our video testimonials page.

Our producer met Lisa Purchase when she recorded self-promotional videos in our facilities before the renovations were done during the pandemic.

Regardless, apparently, usury and manipulation of seniors is such a common thing at Verico the Mortgage Station that they were convinced that they would just get away with it. The completely one-sided investigation by the first detective of the South Simcoe Police Service and his dismissive decision to not even speak with the victim shows why these brokers felt they were protected.

We have been posting this story for more than a year, yet nobody has threatened us with legal action or even sent us an indignant email feigning innocence.

Verico the Mortgage Station claims sales of more than $5 million, and according to a press release by the newly established owners of HomeEquity Bank, they are valued at more than $5 billion. Regardless, neither of them has taken any action through the courts to silence this story because they know we are telling the truth and we can back it up with evidence. That simple truth is that seniors across Canada are reading our story, and it is inevitable that any company associated with Verico or HomeEquity Bank will be adversely affected by the actions and crimes of the brokers of Verico the Mortgage Station.

This ripple-through effect is best demonstrated by how all lettuce distribution companies see a dramatic drop in sales whenever a salmonella scare regarding a single brand is reported on the radio.

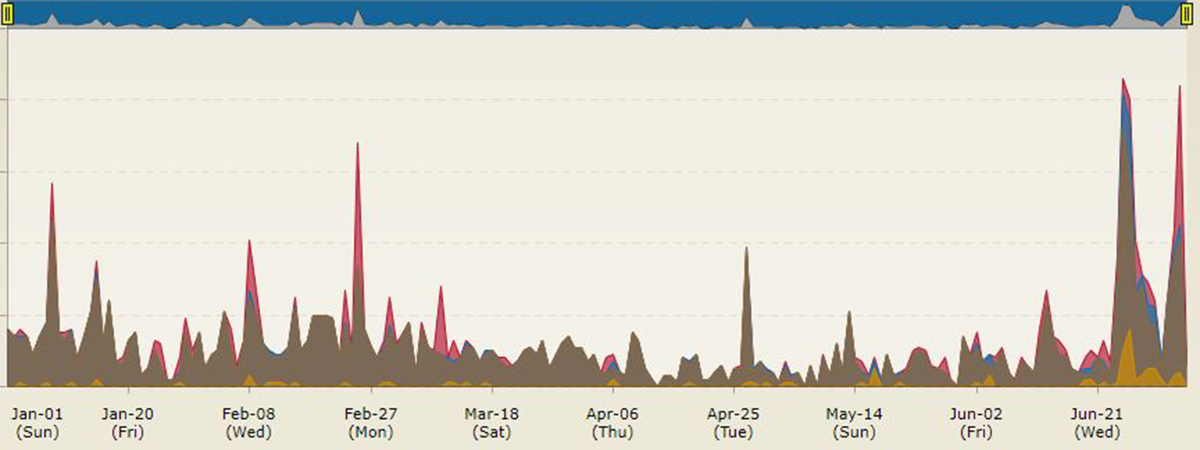

We experienced the biggest explosion of traffic ever after posting this story.

During the past two weeks, since we released details of our new documentary series, traffic to our website and this story have grown dramatically. This graph shows the sudden increase in traffic and the exact timeframe of the sudden explosion of interest. It occurred immediately after we released the story of how brokers at Verico the Mortgage Station illegally deducted usury levels of interest from the disbursement of funds paid out of a CHIP Reverse Mortgages that was provided by the HomeEquity Bank.

From the comments we have received, the main point of interest for most of those following this story is that while we are openly making these allegations of usury and manipulation, the brokers at Verico the Mortgage Station and the staff at HomeEquity Bank are not responding.

One thing seniors know best is that hiding is the tactic of the guilty.

Due to public pressure, and likely some emails from members of Innisfil Town Council, the brass at the South Simcoe Police Service conceded that the investigation by the initial detective was . . . let’s say wanting. In response, they assigned a specialist fraud investigator. That is not something they would have done had it not been obvious to everybody that something was seriously wrong with the investigation undertaken by Detective Smith, who could not do basic math and who did not even talk to the complainant, but instead followed the commands of the brokers at Verico the Mortgage Station like he had been somehow motivated to do so.

No reasonable person would believe that a qualified detective could not tell the difference between 12% and 120% interest rates charged on a loan.

We have been in direct contact with ALL parties in this matter, and so far, NONE of them have mustered the courage to tell their side of the story on camera. This duck-and-hide tactic of denial has been used by multiple politicians and business owners whom we, as journalists, have exposed for fraud and other abuses. In every single case, the person who tried to avoid scrutiny generated more of it, and in the end, they ALL lost heavily.

Their collective decision to hide from the evidence of these crimes will do nothing but hurt business at every Verico brokerage and at the HomeEquity Bank.

They will be painted by the public with the same brush as those at Verico the Mortgage Station. Clearly, from their signage alone, it is obvious that the CHIP Reverse Mortgage is a big seller at Verico the Mortgage Station. However, in the best interest of the public and their own image, the HomeEquity Bank could just as easily sell it through another broker in the area. Also, in their own best interests, Verico could withdraw their name from the brokerage and cut all ties. They could then open another office free of the accused brokers who are currently under investigation by a fraud detective. It seems inevitable that when charges are laid based on the evidence and not biased by privilege or influence, these companies will cut and run to save their own reputations.

There is little wonder that so many seniors are interested in and following this story that directly affects their livelihood and financial security.

The same evidence that compelled the top cops at the South Simcoe Police Service to discard the initial investigation and call in a fraud investigator is being sent now to the Financial Services Regulatory Authority of Ontario which regulates the mortgage brokerage industry. They will not be fooled by claims of interest that the detective from the South Simcoe Police Service had to reduce by 90% in order to protect the loan sharks at Verico the Mortgage Station. They will also be able to do the math that our producer had to simplify so that the Inspector at the South Simcoe Police Service could understand it.

“qui cum canibus concumbunt cum pulicibus surgent”